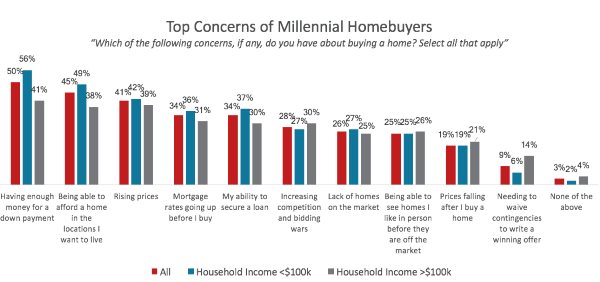

According to a recent survey, the top concern among first-time millennial homebuyers was having enough money for a down payment, with 50 percent citing that response, followed by affording a home in their preferred location (45%) and rising home prices (41%).

Redfin commissioned a survey of 2,000 U.S. residents who planned to buy or sell a primary residence in the next 12 months. The purpose of the survey was to better understand the objectives, perspectives and concerns of those about to enter the real estate market. Redfin commissioned a survey of 2,000 U.S. residents who planned to buy or sell a primary residence in the next 12 months. The purpose of the survey was to better understand the objectives, perspectives and concerns of those about to enter the real estate market.

Aside from the 69 percent who saved directly from paychecks, millennials used several tactics and sources to accumulate the money needed for a down payment on their first home. Thirty-six percent used earnings from a second job, 13 percent pulled money out of retirement funds early and 10 percent sold cryptocurrency. Some were lucky enough to have received a cash gift from their family (24%) or an inheritance (12%).

When broken down by household income levels, there were some notable differences in how millennials achieved a down payment. Millennials in households earning more than $100,000 per year were less likely than those earning less to have saved directly from paychecks, with 60 percent of high-earners having done so, compared with 75 percent of those who earn less than $100,000. Millennial households earning more than $100,000 were more than three times more likely than their less-well-off peers to have sold cryptocurrency investments and twice as likely to have sold stock investments. They were also more likely to have received an inheritance or cash gift from family or to have dipped into their retirement savings.

To afford a mortgage, 65 percent of millennials who intend to buy their first home this year plan to take some action, aside from just paying from their regular paychecks:

32% plan to pursue additional employment

19% intend to rent out a room to someone they know

15% say they will drive for a ride-sharing service

14% plan to split ownership of the home with friends or roommates

Source: RedFin

What Happened to Rates Last Week?

|

| |

Mortgage backed securities (FNMA 4.50 MBS) gained just +7 basis points (BPS) from last Friday's close which caused fixed mortgage rates to move sideways for the week.

Overview: We had a net change of just 7 basis points. Generally, it takes around a 21 basis point movement for rates to be impacted. We had a big week for economic data with high inflation (PCE) and strong manufacturing data as well as very positive readings on the consumer. Usually, that type of economic data is very negative for mortgage rates. However, last week's data took a back seat to the swirling changes in trade talks and escalating tariffs which more than offset the downward pressure from the economic data.

Inflation Nation: The Fed's "official" measure of inflation, PCE (personal consumption expenditures) was hotter than expected with the headline YOY number hitting 2.3% vs est of 2.2%. It was at 2.0% when the Fed's raised rates at their last meeting. The Core YOY number hit 2.0% for the first time since 2012! Personal Income matched market expectations with a 0.4% MOM change and Personal Spending improved by 0.2% but that short of the estimates of 0.4%.

Manufacturing: The Bell-Weather Chicago PMI posted a block-buster reading of 64.1 vs est of 60.1. This is the second highest reading this year and one of the highest readings on record. Some internals show problems filling vacant job openings, rising costs and increased new orders and backlogs. Just about everything that points to growth in the manufacturing sector.

Consumer Sentiment Index: The final reading for June was 98.2 vs May's reading of 98.0, so MOM it did improve. Inflation Expectations for the next 12 months moved up to 3.00%. Consumer Confidence: The June data was below expectations (126.4 vs est of 128) but ANY reading above 120 is an extremely high level and points to strong consumer spending.

GDP: We got the final and third look at the 1st QTR GDP. The final revision dropped to 2.0% which is down from the last revision of 2.2%. The surprise came in the form of the Price Index which jumped up to 2.2% from the last revision of 1.9%.

|

What to Watch Out For This Week:

The above are the major economic reports that will hit the market this week. They each have the ability to affect the pricing of Mortgage Backed Securities and therefore, interest rates for Government and Conventional mortgages. I will be watching these reports closely for you and let you know if there are any big surprises.

It is virtually impossible for you to keep track of what is going on with the economy and other events that can impact the housing and mortgage markets. Just leave it to me, I monitor the live trading of Mortgage Backed Securities which are the only thing government and conventional mortgage rates are based upon.

|

Trackbacks

Comments

Display comments as Linear | Threaded

Leave A Comment