About This Blog

Gold Canyon Mortgage Blog

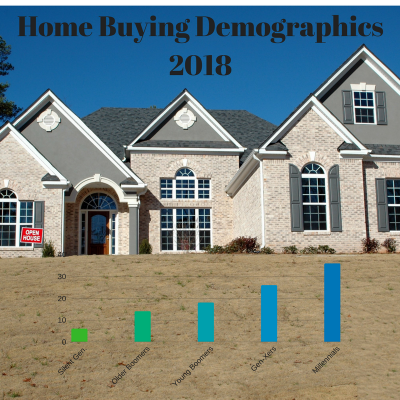

Who is driving the super-hot demand in housing right now? The answers are found in the newly published National Association of Realtors 2018 Home Buyer and Seller Generational Trends.

Millennials are now buying more homes than any other group with thirty-six percent of all home purchases were made by that generation over the last year. That makes millennials the most active generation in home buying for the fifth straight year. Gen-Xers ranked second at 26%, followed by younger and older baby boomers at 18% and 14%, respectively. The silent generation – those born between 1925 and 1945 – accounted for 6% of homebuyers over the last year.

First-time buyers made up 34 percent of all home buyers, a decrease from last year at 35 percent. Sixty -five percent of buyers 37 years and younger were first -time buyers, followed by buyers 38 to 52 years at 2 4 percent.

Sixty-five percent of recent buyers were married couples, 18 percent were single females, seven percent were single males, and eight percent were unmarried couples. The highest percentage of single female buyers was found in the 72 and older age group. The highest share of unmarried couples were found in the 37 and younger age group.

The most common reasons for recently purchasing a home differed between the generations. For all three groups under the age of 62 years, the main reason for purchasing was the desire to own a home of their own. Among the 63 and older age groups, the desire to be closer to friends and family was the top reason to purchase at 25 percent. Buyers between 72 and 92 years also purchased for the desire for a smaller home at 19 percent.

Overall, buyers expect to live in their homes for a median of 15 years, while 18 percent say that they are never moving. For buyers 37 years and younger, the expected length of time is only 10 years compare to 20 years for buyers 53 to 62 years.

Mortgage backed securities (FNMA 4.00 MBS) gained +13 basis points (BPS) from last Friday's close which caused fixed mortgage rates to move sideways for the week.

Overview: We continued to see sideways movement in long bond yields throughout the month of March as the market is awaiting the first Fed rate hike of the year. Overall, last week had very strong labor market data and both small business and consumers had some of the highest sentiment readings on record. Inflation was tame but above 2.00% on headline CPI.

Jobs, Jobs, Jobs: January JOLTS (Job Openings and Labor Turnover Survey) showed over 6 million vacant jobs....just waiting for the right person (that can pass a drug test, and has experience/skills). This was a much stronger than expected reading (6.312M vs est of 5.890M) and is at a record high.

Consumer Sentiment: The University of Michigan's Consumer Sentiment Index Preliminary March reading hit 102.00 vs est of 99.3 and is one of the hottest readings on record.

Small Business Optimism: The February NFIB index moved higher from January's level of 106.9 to Feb's reading of 107.6. It the 2nd highest level in 45 years!

Inflation Nation: Across the board, the Consumer Price Data matched market expectations with the closely watched YOY headline reading rising to 2.2% in February from 2.1% in Jan. The Core YOY remained at the 1.8% level. Producer Price Data matched also market expectations with the closely watched YOY Headline reading rising to 2.8% in February from 2.7% in Jan. The Core PPI YOY rose from 2.2% to 2.5%.

Atlanta Fed: Their Year ahead inflation expectations rose from 2.0% in February to 2.1% in March. However, their GDPNow forecast model dropped the 1st QTR GDP expectations down to 1.9%. If you recall, this was 5.2% in January, dropped to 4.3% and then 2.5% and now 1.9%.

Manufacturing: The February Industrial Production figures were almost three-times stronger than expected with a 1.1% vs an estimated 0.2% reading. Capacity Utilization was also a beat (78.1 vs est of 77.6). There was strength in mining, business equipment and building supplies.

Gold Canyon Mortgage Blog

Trackbacks

Comments

Display comments as Linear | Threaded

Leave A Comment